The Burlington real estate market is buzzing with activity right now. This is sparking a lot of curiosity about the best steps to take, whether you're considering buying or selling a home in Burlington.

As your Burlington real estate agents, we're here to break everything down. We hope this post gives you clarity on what's happening in the Burlington real estate market this September.

Let's take a look together shall we?

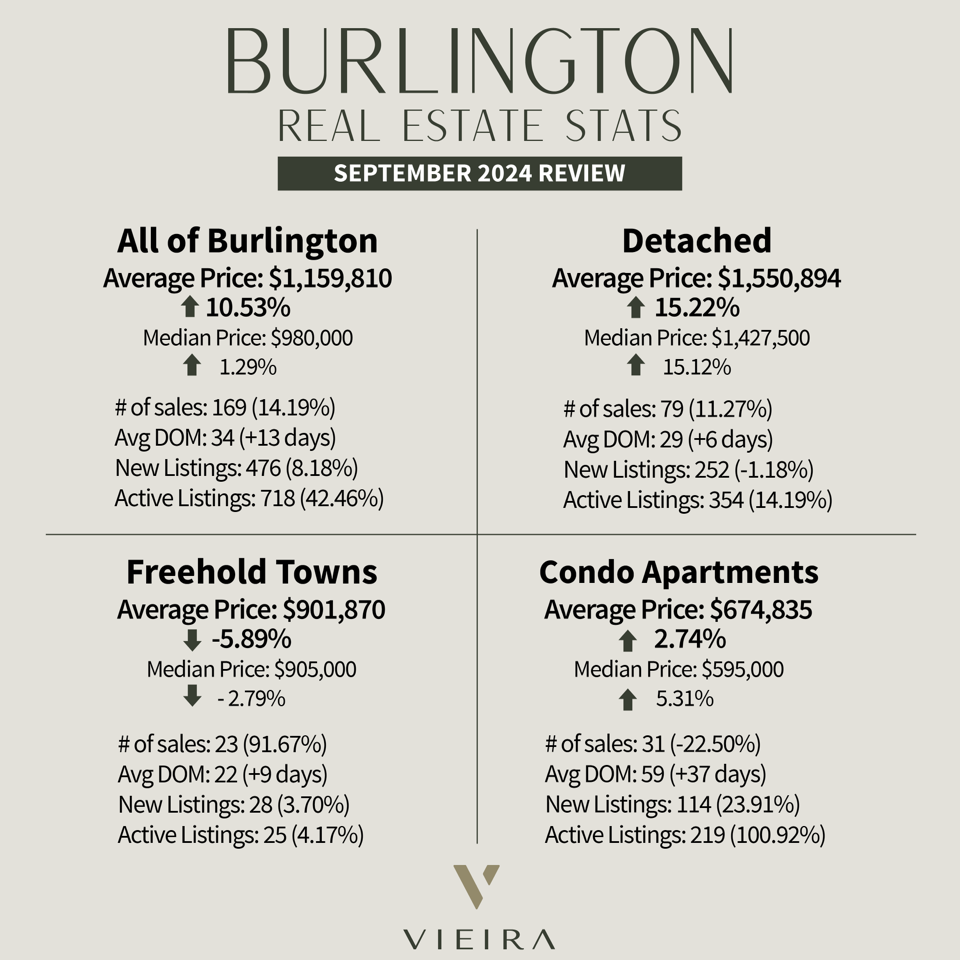

Sales volume increased in Burlington by 14% in September over the same month last year and by 7.63% across the GTA. This is a positive sign although available inventory still remains high.

Months of inventory, the metric used to assess the type of market we are in, was a little over 4 months which is a balanced market. Burlington has fared far better than Oakville which has 5.8 months of inventory and all of the GTA at just over 5 months.

All things considered, prices have managed to hold onto most of the gains through COVID and are still well above pre-COVID averages. Average days on the Market was up across all property types and the sense of urgency/scarcity that drove our market for years has faded as properties sit on the market longer.

Buyers that are able to qualify and looking to buy are taking their time as there is many options available to them.

The BoC has cut rates in the last two policy meetings and many expect another cut on Oct 23rd as high as 1/2%. We are optimistic that further cuts will start to bring affordability inline with prices and sales volumes should start to return to more historic averages. That being said, it will take some time to work through a large amount of available inventory and it could take months before the market tips back in the seller's favour.

The government of Canada introduced some policy changes recently. Insured mortgages (buyers putting less than 20% down) are now capped at $1.5m up from the previous max of $1m. They are also allowing 30 year amortizations for first-time buyers and anyone buying new construction.

This should help more buyers get into home ownership and possibly stimulate the market.

If you’re curious about the value of your home or simply want to discuss the market, feel free to reach out “We Love Talking Real Estate!”

.png)

Post a comment